Este artículo también está disponible en español.

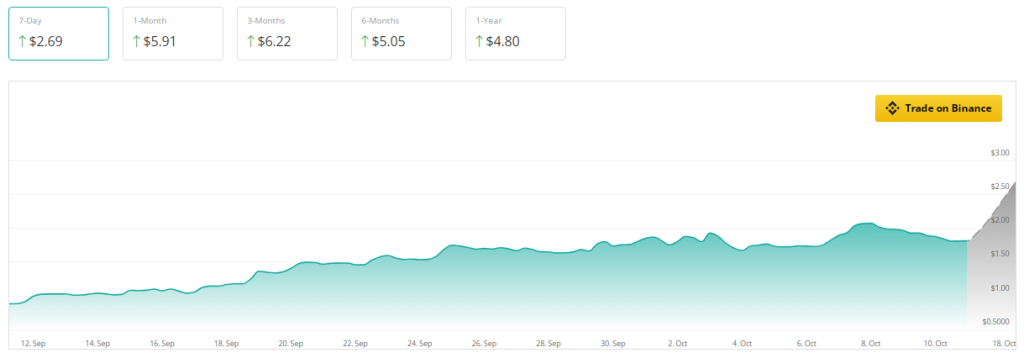

Over the past 30 days Sui [SUI] has been on a roll, tripling its market capitalization and showing outstanding growth. Over 100% increase in value drove the token’s market capitalization above $5 billion. But as is always the case with cryptocurrencies, what rises must fall at least momentarily.

Source: Coingecko

Related Reading

The coin’s surge is exhibiting indications of stalling after weeks of increasing momentum. Traders are now closely observing what can happen next for this once-red-hot asset. According to crypto price prediction site CoinCheckup, SUI is selling 220% below its expected price for next month, suggesting a possible undervaluation.

Price Slips And Declining Market Activity

SUI was trading at $1.84 at press time after losing 5% of its value within only 24 hours. Based on CoinMarketCap, trading volumes have likewise dropped by 4%. This decline in activity suggests, at least for the time being, a decreasing interest in the token.

The technical signs hardly seem much better. Tracking money flow into and out of an asset, the Chaikin Money Flow (CMF) has also been on a downward slope in the last seven days. This is an indication that money is fleeing SUI, usually leading to issues for price stability. Moreover, the CMF has entered negative territory, suggesting that purchasing interest is currently subordinated to selling pressure.

SUI: Slowing Momentum But Potential Bounce

The token started to sell off as its Relative Strength Index (RSI) dropped below a key signal line, indicating declining momentum. Still, there is a positive aspect here. Should the RSI show a positive turn once more, it may indicate a buying chance for those who think SUI has long-term promise.

If selling keeps on, analysts say SUI might test support at $1.70; this might not be a negative outcome. Strong support levels draw buyers who see value at lower levels, thereby acting as a basis for the price to increase once again. SUI will have to barrel its way past the resistance at $2, a fundamental psychological and technical barrier, if it is to break out from its present downturn.

Cooling Interest

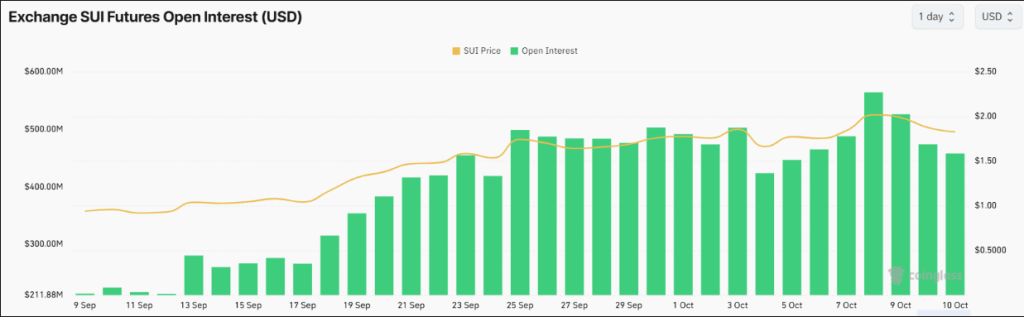

Meanwhile, SUI, which has lately been seeing explosive growth, also seem to be cooling off. From an all-time high of $560 million to $450 million, open interest declined 10% over the past 24 hours. This implies that traders are closing positions as excitement declines, thus helping to explain the general sell pressure on the coin.

Some traders would see the drop in open interest as a sign of opportunity even with this cooling off. Prices falling always mean that buyers will re-enter the market, particularly if they feel SUI is underpriced.

Related Reading

SUI still has promise long term. Over the following three months, analysts project a possible 240% price rise; over the next year, a 160% increase. For SUI, especially with a long-term perspective, the future appears bright even if the road ahead could be rocky.

Featured image from ThoughtCo, chart from TradingView

#SUI #Rallies #Signs #Fatigue #Emerge #Drop #Incoming

Source link